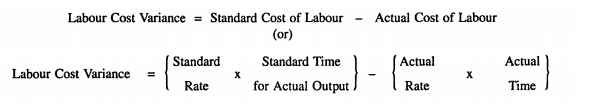

The total direct labor variance can be calculated in the last line of the top section by subtracting the actual amounts from the standard amounts. The standard quantity allowed of 37,500 direct labor hours less the actual hours worked of 45,000 hours yields a variance of (7,500) direct labor hours. This variance is unfavorable because the actual hours worked exceed the standard hours allowed. The direct labor rate per hour variance is calculated as the projected standard direct labor rate of $18 per hour, less the actual direct labor rate of $18.50, which yields a $(0.50) unfavorable per hour rate variance. The total direct labor variance is the total standard labor costs allowed of $675,000 less the actual amount paid for direct labor of $832,500, which is $(157,500) unfavorable.

Learning Outcomes

If, however, the actual rate of pay per hour is greater than the standard rate of pay per hour, the variance will be unfavorable. Where,SH are the standard direct labor hours allowed,AH are the actual direct labor hours used, andSR is the standard direct labor rate per hour. If customer orders for a product are not enough to keep the workers busy, the production managers will have to either build up excessive inventories or accept an unfavorable labor efficiency variance. The first option is not in line with just in time (JIT) principle which focuses on minimizing all types of inventories.

Get in Touch With a Financial Advisor

The total amounts for direct materials actually purchased and used are reported on the following line. The actual quantity purchased and used to produce 150,000 units was 600,000 feet of flat nylon cord costing $330,000. The actual price of $0.55 per unit is not given in the actual data presented in Exhibit 8-1. However, it can be calculated by taking the total purchase price and dividing it by the total number of feet purchased. Together with the price variance, the efficiency variance forms part of the total direct labor variance. Before we go on to explore the variances related to indirect costs (manufacturing overhead), check your understanding of the direct labor efficiency variance.

Direct materials quantity variance

Since the baseline theoretical inputs are often calculated for the optimal conditions, a slightly negative efficiency variance is normally expected. The actual hours used can differ from the standard hours because of improved efficiencies in production, carelessness or inefficiencies in production, or poor estimation when creating the standard usage. Hence, variance arises due to the difference between actual time worked and the total hours that should have been worked. During the planning stages, the management staff might have projected that it will take 50 labor hours to produce one unit of a specific product. However, after the first round of products is completed, records indicate that 65 labor hours were used, to complete the item in question.

It could mean that the direct materials quantity standard needs to be reduced to achieve an accurate standard variable cost per unit. Or, further investigation might reveal a production error in which the units were improperly sized, which is a significant quality control issue. In this case, the actual hours worked are 0.05 per box, the standard hours are 0.10 per box, and the standard rate per hour is $8.00. This is a favorable outcome because the actual hours worked were less than the standard hours expected. The direct labor variance measures how efficiently the company uses labor as well as how effective it is at pricing labor. There are two components to a labor variance, the direct labor rate variance and the direct labor time variance.

Direct labor efficiency variance

This figure can vary considerably, based on assumptions regarding the setup time of a production run, the availability of materials and machine capacity, employee skill levels, the duration of a production run, and other factors. Thus, the multitude of variables involved makes it especially difficult to create a standard that you can meaningfully compare to actual results. Labor yield variance arises when there is a variation in actual output from standard.

Indirect materials are included in the manufacturing overhead category, not the direct materials category. However, they spend 5.71 hours per unit (200,000 hours /35,000 units) on the actual production. Due to the unexpected increase in actual cost, the company’s profit will decrease.

Only recurring processes benefit from tracking this variance; in cases when commodities are produced infrequently or over a lengthy period of time, tracking this variance serves little purpose. If this cannot be done, then the standard number of hours required to produce an item is increased to more closely reflect the actual level of efficiency. During the year, the company spends 200,000 hours producing 35,000 of output. If however, it is accrual accounting considered to be significant in relation to the size of the business, then the variance needs to be analyzed between the inventory accounts (work in process, and finished goods) and the cost of goods sold account. Tracking this variance is only useful for operations that are conducted on a repetitive basis; there is little point in tracking it in situations where goods are only being produced a small number of times, or at long intervals.

Total direct material costs per the standard amounts allowed are the total standard quantity of 630,000 ft. times the standard price per foot of $0.50 equals $315,000. Per the standard cost formulas, Brad projected he should have paid $315,000 for the direct materials necessary to produce 150,000 units. At the highest level, standard costs variance analysis compares the standard costs and quantities projected with the amounts actually incurred. These standards are compared to the actual quantities used and the actual price paid for each category of direct material.

- During the period, 45,000 direct labor hours were actually worked and actual variable manufacturing overhead of $121,500 was incurred.

- When a company makes a product and compares the actual labor cost to the standard labor cost, the result is the total direct labor variance.

- Manufacturing overhead includes all costs incurred to manufacture a product that are not direct material or direct labor.

- While the sudden increase in sales demand was exciting, Patty was not expecting the sudden increase in production so she experienced a number of production issues.

- Connie’s Candy paid $1.50 per hour more for labor than expected and used 0.10 hours more than expected to make one box of candy.

Any discrepancy between the standard and actual costs is known as a variance. Standard variances are considered a red flag for management to investigate and determine their cause. In Company Zeta’s case, actual labor hours significantly exceeding the standard hours indicate inefficiencies in labor use, leading to additional labor costs. Conversely, fewer actual hours than standard would denote improved efficiency and cost savings.

Management needs to investigate and solve the issue by reducing the actual time spend or revising the standard cost. We have demonstrated how important it is for managers to beaware not only of the cost of labor, but also of the differencesbetween budgeted labor costs and actual labor costs. This awarenesshelps managers make decisions that protect the financial health oftheir companies.