Contents:

They can also advise you on what to do if the actual numbers deviate from the predicted ones. NerdWallet strives to keep its information https://1investing.in/ and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution’s Terms and Conditions. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly.

- We’ll walk you through everything you need to know to get going yourself, for free.

- A perfect budget evaluates previous years’ data and draws realistic projections.

- Know whether you need to cut expenses or increase revenue to achieve your strategic, operational, and financial goals.

- Business debit cardintegrated with your accounting software, and budget envelopes, making it easy to manage your business finances.

- Are you looking for ways to make more money and make your small business more successful?

- Variable costs don’t come with a fixed price tag—and will vary each month based on your business performance and activity.

If business is slower during certain times of the year, consider trimming down variable expenses, such as marketing costs, to make more room in your budget. More broadly, budget records estimated revenues, fixed expenses, variable expenses, and profit margin. Every section is sub-categorized according to the types of expenses and revenues. You can check the step-by-step guide to create a small business budget to know what should be included in a small business budget.

Benefits of Business Budget Planning

Even celebrities manage their living within their prescribed budget. Remember, creating and maintaining financial statements; such as balance sheets and cash flow statements will help you create a backup for your business. It will not only help you keep a record of your financial expenses, but present your business more positively.

The Spring Budget 2023 – Corporate Highlights – Lexology

The Spring Budget 2023 – Corporate Highlights.

Posted: Fri, 14 Apr 2023 06:01:15 GMT [source]

The line items that command the most funding are high-priority items like the sources of revenue and the different types of expenses. These items demand precise bookkeeping and serve as performance indicators of the overall business strategy. This is an ongoing process, so always review your goals at the end of the month or quarter to see if you’ve met them or if you should revisit your budget.

As with most things that come with managing an organization, budgeting needs to be driven by the vision and the strategic plan . Divvy is yet another software developed for savvy entrepreneurs who want to do budgeting with freedom. Divvy is not too old in the market, but the features it offers are impressive.

If this isn’t the first business you’ve started, you know you’ll always get surprise expenses when you least expect it. Then right after getting a life-changing contract, your main printer breaks down before you even start. If you want to be successful in business, then you need to know where every dollar goes. It’s not enough to have a rough idea—it needs to be on paper. But according to a study by Clutch, 46% of small businesses don’t have a declared budget. The beginning cash balance for February ($10,500) is the ending cash balance for January, and this connection applies to each month of the year.

Manage everything in one place.

Unlike fixed costs, variable costs are, as their name implies, based on usage rather than established and repeating patterns. A business budget template is vital to keep your expenses and financial goals up to date. A good template makes it easy for you to see how much money you have available, what you need to pay for, and how much money you have left after covering your necessary expenses.

The software can run smoothly on most operating systems, including Windows, Linus, Macintosh OS, etc. Following are ideas I use in preparing budgets and which I share with my SCORE clients. If you own an established business, you have the results from last year, and you know where you exceeded or fell short of last year’s budget. Give your clients touchless payment options, including credit and debit—with no hidden fees. Free Tools Easy-to-use tools for anyone in home service looking to simplify their day-to-day.

Step 3: Calculate your net income

Instead of reacting to what happened in the past, you can be proactive about where you dedicate resources. You may decide to make changes in pricing, for example, even eliminate certain products or services. If that sounds like your business, take a moment to pause and consider why the budgeting process can be valuable to your business. It can give you valuable data about your business along with a direction for using that data to make smarter financial decisions. You have the freedom to export, import, or synchronize data with the software for smooth working and reporting. Buddi can be used for personal budgeting, small business budgeting, and the budgeting of large corporations.

The amount of extra money you decide to keep aside is up to you. A good rule is to save around three to six months worth of monthly outgoings to make sure you protect your business during any problems. Once you have a basic small business budget, you can start playing with the numbers.

Finally, it’s time to combine your revenue and expenses into a monthly, quarterly, or annual profit and loss statement . Rather than spending time on attempting to manage finances, Navan gives small business owners time back to spend on their passions, on the ground, and in front of customers. Repeat this process for several months to understand the monthly income a small business may incur. Most companies break this revenue data down by months, quarters, and years to compare over time for seasonality. If a company can more accurately predict dips, it can prepare a better cushion to fall back on.

Save and Update Your Budget Regularly

The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. Read our editorial process to learn more about how we fact-check and keep our content accurate, reliable, and trustworthy. If you’re opening a new business and have little or no history, you need to make up for that lack of a track record with detailed support for your budget.

Furthermore, an effective budget can help small business owners identify areas where they can make savings and streamline processes to become more efficient. Budgeting also provides an opportunity for small business owners to forecast future sales based on actual performance, which can help with understanding where profits are likely to come from. Use our free small business budget template to build your own budgeting spreadsheet and consistently track revenue and expenses. Whether you’re planning to launch a small business or you’re a seasoned professional, small business budgeting rarely sounds fun. You just need to follow tested steps so you can secure your bank account and improve your business’s chances of success. If you’re looking for a quicker and less error-prone way to build a small business budget, consider accounting software.

If HR needed $5000 last year for staffing and recruiting, it does not mean that the same amount should be allocated next year. In zero-based budgeting, the budget resources are allocated on a need basis. It is possible that this year marketing and advertising needs higher amounts. And you can know this only if you have a budget prepared ahead of allocation. Before we get into how to create a small business budget, it is important to answer why a business needs a budget. Small businesses should plan carefully for both upfront and long-term capital expenditure as it will have a major impact on their operating budget.

- In zero-based budgeting, the budget resources are allocated on a need basis.

- You might even want to create a separate bank account to stash your tax money just to make sure you don’t overspend.

- You can budget for different upcoming obligations to make them less of a financial burden.

- And for 2022, that plan is especially critical as inflation is growing faster than the historical average.

- However, when a small business has planned everything and kept a budget to invest in new opportunities, it can grow without burdening the business with loans.

- You have positive cash flow if there is more money coming into your business over a set period of time than going out.

Figure out what you’ll ultimately have to charge to maintain your margins, and try to predict whether customers will be willing to pay that price. Your fixed costs won’t change month to month, so they are the easiest to subtract from your income. Fixed costs might include rent, salaried employees, and non-variable utilities. If you find that you have come to the end of a short month, and your business is in the red, don’t let that number get you down — instead, set an attainable goal for improvement. Take a look at whether this deficit was caused by factors you can adjust within your variable expenses, such as transportation costs. Arguably, the most tricky aspect of your small business budget to plan for are one-time and emergency expenses.

You identify what you own of value , estimate your upcoming expenses, and account for and grow your revenue base. Variable costs don’t come with a fixed price tag—and will vary each month based on your business performance and activity. These can include things like usage-based utilities , shipping costs, sales commissions, or travel costs. When building a small business budget, you need to figure out how much money your business is bringing in each month and where that money is coming from. You have positive cash flow if there is more money coming into your business over a set period of time than going out.

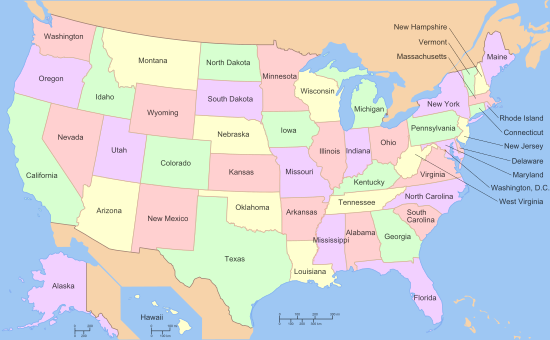

NJ COVID-19 relief funds have not been spent, report finds – NorthJersey.com

NJ COVID-19 relief funds have not been spent, report finds.

Posted: Thu, 13 Apr 2023 20:20:28 GMT [source]

It will make the picture clear about what to expect from your budget in the future. Now, let’s get into a simple process for creating your own budget. But you will already know how much your small business can spend on marketing. That way you won’t overspend and instead use $20,000 for other marketing efforts.

You can also perform different analyzes on your wave accounting data. The variable costs of your business might vary from month to month or every year. Usage-based utilities, shipping costs of orders, etc., are common variable expenses most businesses incur.