Va Fund supply flexibility of settlement costs, that’s included in the vendor, the lending company, or even paid by homebuyer within the mortgage. These financing and additionally reduce quantity of closing costs and you can charges lenders may charge, subsequent protecting the consumer off way too much expenditures.

So you’re able to be eligible for good Va Loan, applicants have to see particular solution criteria, instance a specific duration of services regarding army, payday loans online Massachusetts National Guard, or Reserves. Qualifications along with reaches particular enduring partners out of service professionals.

Va Funds try an invaluable money if you have served about military, providing an available way to homeownership even rather than a top credit score or the ability to generate an enormous deposit. The blend out of versatile borrowing requirements, no advance payment, or any other consumer-friendly possess create Virtual assistant Financing a good choice for eligible experts and you will solution people looking to purchase or re-finance a property .

USDA Finance

These loans, backed by the usa Agencies of Agriculture , are made to promote homeownership during the reduced urbanized section, giving support to the growth and you will durability from rural groups.

Such as for example Va Money, USDA Financing you should never purely demand the absolute minimum credit score, providing significant autonomy to possess potential homebuyers. This approach aligns with the program’s purpose of making homeownership a great deal more easily obtainable in rural components.

not, a credit rating off 640 or higher might be suitable for a sleek mortgage handling feel. Homeowners which have results within this assortment are usually qualified to receive the USDA’s automatic underwriting system, that expedite the fresh approval process. To have candidates with results less than which endurance, a hands-on underwriting procedure will become necessary, which is additional time-sipping and pertains to a very comprehensive examination of the newest homebuyer’s borrowing records and you will monetary profile.

USDA Loans have become good for qualified outlying homeowners due to its favorable terms and conditions. One of the most significant professionals is the odds of 100% financing, definition eligible homebuyers can acquire financing without a down-payment.

Such loans often include faster home loan insurance premiums compared to the Old-fashioned and you may FHA Money, ultimately causing all the way down monthly payments and you can while making homeownership cheaper. USDA Money are also recognized for their generally competitive interest levels, next improving the interest people looking to purchase land inside outlying parts.

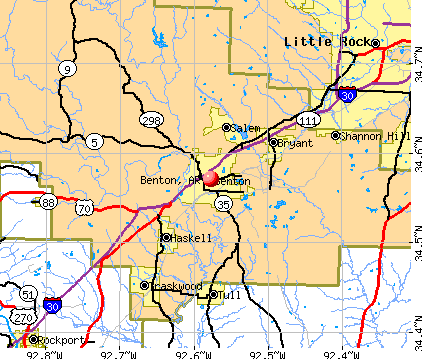

To be eligible for a USDA Mortgage, the house or property need to be based in a place designated as the outlying by the USDA. Potential housebuyers is also see the qualifications away from certain cities towards the USDA’s web site .

Applicants should fulfill specific income limitations, different by part and family proportions. This type of limits are prepared to ensure the program serves those who certainly need assistance within the getting homeownership. Most other basic criteria become United states citizenship otherwise permanent property, a steady money, and you may a track record of responsible borrowing from the bank have fun with, even when the credit rating are underneath the needed 640.

USDA Finance render a great road to homeownership for these lookin to reside outlying parts. While they usually do not strictly need a premier credit rating, aiming for 640 or above is express and you will automate the new financing process.

Understanding the book benefits and needs from USDA Money is crucial for the potential homebuyer considering property when you look at the a rural area.

Lender’s Position to the Credit ratings

Lenders make use of your credit score because a first equipment to measure the threat of lending for you. Increased credit score ways a track record of in charge credit management, decreasing the lender’s chance and sometimes converting for the a lot more positive financing terminology, including down interest levels and higher financial conditions. On top of that, a lesser credit rating might lead to highest interest levels or also financing assertion.