- Comment Your credit report having Problems: Make sure your credit file is free of charge off problems. Errors is unfairly decrease your score and you may impact your loan speed.

- Understand Debt Records: Loan providers look at the financial history, together with your credit card debt, fees habits, a good debts, and income balance. A substantial financial history normally place you within the a better updates to help you discuss straight down prices.

Maintaining good credit and you will an effective credit history is crucial just to own protecting a home security loan but for people monetary borrowing. Normal monitoring of fico scores and in control financial habits for personal funds can also be significantly improve your probability of delivering beneficial loan terminology.

Throughout the upcoming parts, we will look into tips effectively browse and you will examine family guarantee funds, lenders and you will just what today’s mediocre interest levels feel like to possess house collateral financing. Securing the brand new top family guarantee loan rates involves a mix of individual economic health and markets sense, therefore existence told and hands-on is key.

Researching and you will Comparing Lenders

Finding the right family guarantee loan prices needs comprehensive search and you may evaluation of several loan providers. This action is essential while the other lenders promote different costs, charge, as well as repayment conditions. Here’s how so you’re able to treat it:

- Start by Your existing Financial: Evaluate what prices and you will terminology your existing financial otherwise mortgage vendor has the benefit of. Either, current relationships can cause top sales.

- Grow your Research: Have a look at almost every other financial institutions, borrowing unions, an internet-based lenders. For every might have other criteria and you can promotions.

- Compare Loan Enjoys: Besides the rate of interest, consider other mortgage has actually like charges, fees independency, and you will customer care.

- Look at the Small print: Look for one undetectable can cost you otherwise conditions that’ll apply to you in the long run.

Contemplate, it’s not just about choosing the $255 payday loans online same day Michigan loan amount and you can lower notice speed also protecting financing that meets your general economic means. To have an in depth guide on how best to navigate this process, you can read more about how to get property security loan.

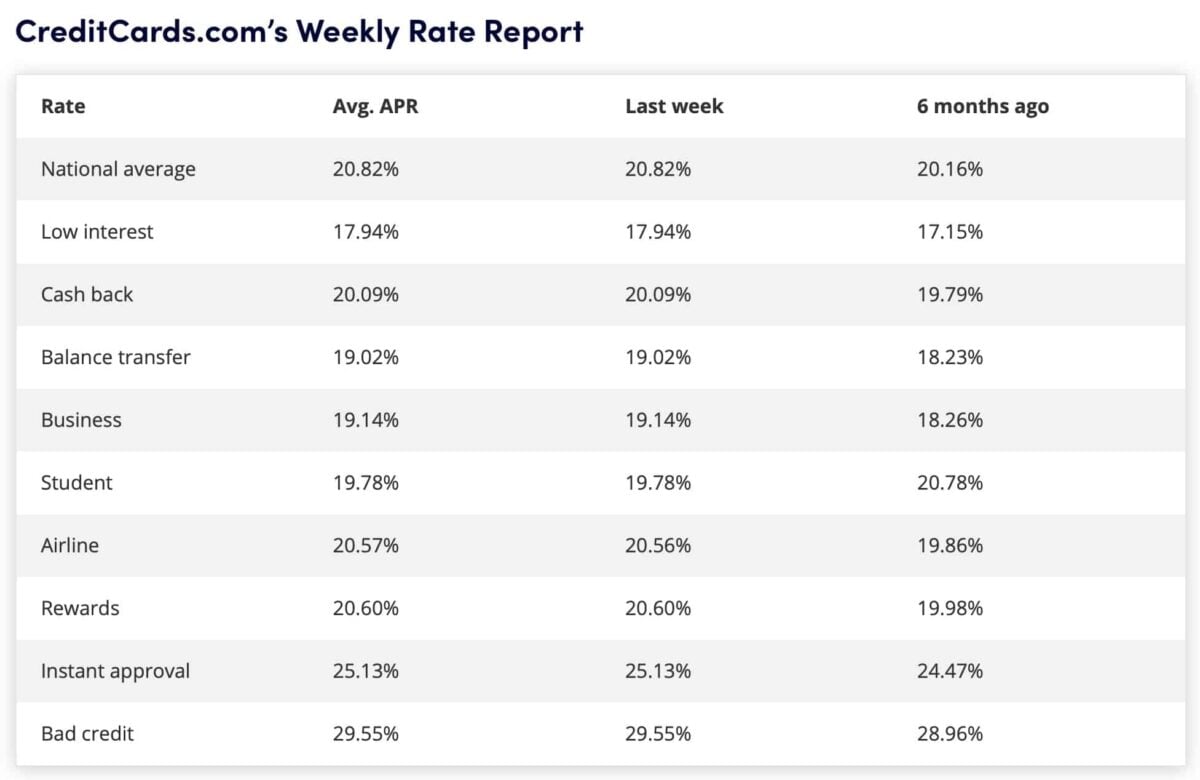

By the present day field, these costs is susceptible to change according to the distinctive line of borrowing and you will macroeconomic trends including rising prices pricing, housing market requirements, and you can shifts in the monetary coverage

The common interest rates for domestic collateral finance may vary, determined by numerous circumstances such as the larger economic ecosystem, main bank procedures, and also the competitive land from lenders. Consumers need certainly to remember that these rates change throughout the years, and you may what would function as the prevailing rate now you will move inside the long run.

Such interest rates along with differ centered on if they are repaired otherwise changeable. Repaired interest rates provide the benefit of uniform monthly obligations over living of the financing, taking stability and you can predictability into the cost management payment per month. Likewise, changeable costs, if you are probably lower initial, can transform through the years according to industry standards. This is why while you might start by down payments compared to help you a fixed speed, there can be a possibility that costs you may boost in the long term.

For those picking out the most current and you may more information on domestic security financing costs, you may want to talk certified economic news offer. Other sites like Reuters besides offer up-to-time information about newest interest rates as well as promote information to the market manner and you may forecasts. This particular article should be indispensable in assisting you safer a home collateral loan you to aligns along with your financial requires in addition to most recent economic climate. Skills these types of facts as well as how it effect domestic security mortgage lender rates will most useful help one to create a knowledgeable decision into an educated home equity financing choice for your role.