The fresh new Coronavirus Assistance, Rescue, and Economic Coverage (CARES) Act, and this provided as much as 1 year regarding forbearance to property owners that have federally supported mortgages, means if home financing debtor covered in rules and you may negatively impacted by the newest pandemic gets in forbearance, its missed mortgage payments will not cause the mortgage going toward default status and won’t negatively affect the borrower’s borrowing score.

not every unpaid mortgage borrowers come in a great forbearance package. Specific individuals are needlessly unpaid-although eligible, they have not entered forbearance. Almost every other consumers has low-agencies mortgages and remain beyond your scope away from institutional forbearance, regardless of if of numerous have worked out good forbearance arrangement physically along with their servicer. Plus the regards to forbearance for property owners having non-institution mortgage loans may differ of institutionalized forbearance implemented underneath the CARES Act.

Such borrowers who will be delinquent although not inside the forbearance is exposed home owners, and enormous display of them inhabit predominantly Black and you may Latina areas.

Centered on credit agency studies, step one.step three per cent out of people that have one to first mortgage had been considered 60 or more days unpaid at the time of , which has consumers who’s started outstanding until the pandemic. When they have been in forbearance, they might still be thought latest to own credit rating objectives.

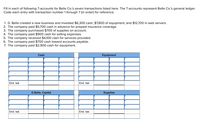

Mortgaged property owners during the predominantly Black colored and you can Hispanic zip rules be much more gonna has actually an unprotected delinquency as opposed to those when you look at the predominantly white zip requirements

Based on an analysis away from borrowing from the bank agency and you may American Community Questionnaire (ACS) study, we discover one people in mainly Black or Hispanic communities is actually some more likely to end up being exposed than others into the predominantly light areas. Which analysis corroborates almost every other look findings showing you to across the of a lot monetary indications, the brand new pandemic has experienced a bad affect communities away from color.

Playing with ACS data, i categorized zero requirements according to research by the largest racial otherwise ethnic class for the reason that urban area because a percentage of one’s populace. We minimal our investigation so you can borrowers with only one first-mortgage so you’re able to divide property owners that have an initial quarters away from people who have numerous homes.

Home owners that have a primary mortgage in mostly Black colored areas was indeed the fresh most likely becoming unprotected (2.3 %), followed by homeowners during the predominantly Hispanic communities (1.six per cent).

Property owners inside mainly light communities was indeed less likely to want to become delinquent getting credit rating purposes (step one.2 percent). Inside the communities where another type of racial otherwise ethnic category (always Far eastern people) makes up the largest show of your own society, simply 0.9 % from residents was basically experienced unprotected.

Unprotected people are more inclined to deal with property foreclosure and other economic consequences

Due to the fact CARES Act’s foreclosures moratorium does not coverage borrowers which have non-service mortgage loans, unprotected people which have non-service mortgage loans deal with a top probability of dropping their home in the event that they may not be inside a really conformedupon forbearance bundle.

Delinquency without the cover out of forbearance, having both service otherwise non-company financial borrowers, will additionally all the way down you to definitely borrower’s credit history. These exposed consumers features fico scores one, within average, are nearly 2 hundred items less than protected and you will latest individuals. Carried on to overlook home loan repayments without having any defense off forbearance commonly next weighing on the scores.

A rigorous borrowing from the bank ecosystem further affects exposed residents

During this time, credit criteria also have tightened, and you may individuals generally you prefer a top credit history so you’re able to secure a beneficial loan.

Usually, domiciles out of colour, and you will Black colored home in particular, had lower credit scores than simply white domiciles, partially on account of architectural traps for the a job, money, and accessibility borrowing from the bank. Therefore, the greater number of ratio out-of exposed mortgaged residents when you look at the neighborhoods from colour you will subsequent aggravate pre-pandemic disparities for the credit rating and you can entry to riches-strengthening devices, whenever you are slowing this new recovery off people of colour and making them next about.

Societal policy efforts you may reduce the negative effect away from unprotected home loan delinquency

Our very own earlier in the day studies towards unnecessary delinquencies suggests that getting exposed borrowers that have a company financial will demand targeted operate, that have shared outreach away from servicers, consumer organizations, plus the authorities. Eg, the us Treasury Company, and this matched up this type of efforts inside the earlier crisis, might take top honors and create consensus certainly stakeholders.

Specific targeting of mainly Black and you can Hispanic neighborhoods is required to ensure outstanding consumers having company mortgage loans get forbearance arrangements. Forbearance pointers should be offered in multiple dialects to arrive consumers when you look at the groups that have proportionately high non-English-speaking communities. Instant outreach tasks are important to address latest racial and ethnic disparities in the delinquencies and to limit racial and ethnic riches disparities once the savings recovers. However, talks having business stakeholders have demostrated that a tiny ratio regarding property owners have denied forbearance, that will complicate outreach jobs.

We also need a lot more studies americash loans Hawleyville, CT to raised comprehend the demographic and you will geographic qualities out-of low-agencies financial borrowers. A current Urban Institute experiences into the forbearance statistics indicated that some investigation source presented significantly more outcomes for the latest show off low-agency mortgage borrowers within the forbearance. So it shortage of analytical agreement can result in an ambiguous visualize of your express regarding low-company borrowers during the forbearance and you may determine efforts to recognize those who need assistance.

Making certain fair opportunities tend to bolster the financial data recovery

Residents from colour was in fact currently disadvantaged till the credit crunch, leading them to more vulnerable so you’re able to an economic surprise. Predictably, the present day downturn enjoys disproportionately harm Black and Hispanic property owners, exacerbating the holes between residents out of color as well as their light alternatives.

These types of exposed property owners out of colour is actually impact the impact of your credit crunch, while the much time-label consequences you will definitely decelerate its data recovery. A slower healing to own homeowners from colour risks after that widening racial and you will ethnic wide range disparities as the economic crisis begins to mend. However the advised principles could help be certain that a lot more property owners away from color refrain this new bad with the recession and are generally within the monetary rebound.

Tune in and register today.

The Urban Institute podcast, Proof actually in operation, motivates changemakers to guide with facts and you may act that have guarantee. Cohosted because of the Urban President Sarah Rosen Wartell and you may Executive Vice president Kimberlyn Leary, all episode provides within the-breadth conversations which have positives and you can management into the subjects anywhere between how to advance guarantee, to help you creating innovative alternatives one go people perception, about what it indicates to rehearse proof-depending leadership.