If you can’t pay your student loans, you can test to get all of them into the an effective forbearance otherwise deferment depending on your situation.

It’s also possible to try an income situated installment plan while the an excellent last resort. A full time income mainly based cost plan fee doesn’t actually safety the brand new focus that accrues, which means this is just be brief and simply if positively requisite.

Must i refinance my personal finance?

You can refinance your finance however, remember that you still need to work as easily that you can to expend them out-of. Refinancing will help save well on focus minimizing their percentage to make it a lot more in check.

If you have alot, it could be good-for re-finance. But not, for those who have small amounts, pay only all of them regarding punctual.

Yes. Firstly, government entities can transform the fresh regards to which of course, if people loans gets forgiven any moment. Next, you can pay it back reduced and you will rescue more funds of the investing it off easily than simply making the minimal fee having 10 ages to have all of them forgiven. 3rd, any kind of amount is actually forgiven counts while the earnings on the taxation go back that could charge you a king’s ransom.

Along with, you must be eligible for a living created decide to be considered for almost all of your own forgiveness programs. Thus, it might seem your meet the requirements and perhaps not. Additionally, it enables you to stuck from inside the a certain work having an excellent long time which may not be everything need. Never remain at a job for the mortgage forgiveness.

Weighing all choice while the costs and you can professionals prior to counting towards education loan forgiveness program. There are many software around if in case your be considered, then higher, take action. But do not forget your figuratively speaking in accordance with the expectations that some day they shall be forgiven.

Ought i pay-off my pupils money or invest?

This most depends on your chance tolerance however, I could constantly lean on the paying all of them out-of. It’s a save bet along with your currency and there’s an effective significant chance a part of owing student education loans.

This would as well as trust what your interest rate is for your financing instead of just how much you might get regarding markets. Having my college loans, indeed there was not far space given that my interest rate is large.

If you pay-off Michigan installment loans online your own college loans alternatively as fast as possible, then you have more cash to invest and then leave throughout the markets prolonged to genuinely obtain.

If you dedicate, youre nevertheless attending have to make monthly installments and you may wait to your getting on expenditures otherwise just be sure to go out the new sector which is never recommended.

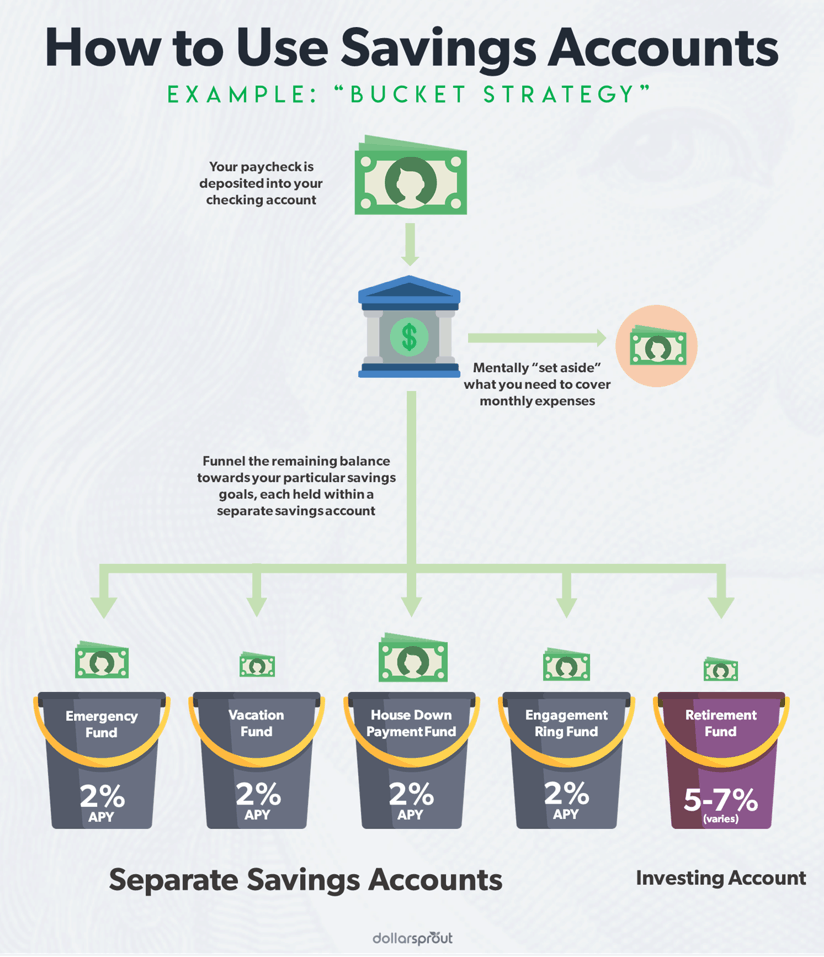

Should i pay-off my personal student education loans or rescue?

So it utilizes your role and in case you may have people recognized dangers springing up. Meaning, do you have something that you need save having nowadays.

Will you be potentially losing employment, with an infant, health issues, moving, or other large expenditures that you experienced regarding coming.

Or even, then repay your student education loans now. You can save getting one thing faster because debt is went.

Your future step:

Now that you are able to see in the event the is possible to repay their student education loans prompt, big date around and you will get it done! Take steps, do some artwork and only Get it done! Get men and women dang figuratively speaking out of your lifestyle Permanently!

- Twitter thirty two

- Pinterest 631

On Ashley

Hello, I am Ashley Patrick, individual financing specialist, and inventor from Spending plans Made easy. We let active mom repay personal debt simple methods so they really can fret shorter and you can real time living they require. I happened to be capable pay back $forty-five,000 in only 17 weeks in addition to $twenty five,000 inside student loans within ten months.I’m a king Monetary Advisor and help anybody as if you create the spending plans for them to live living they need. I’ve been seemed towards the Fox Team, Yahoo! Money, Us Now, MSN, CNBC, Providers Insider, NerdWallet, and others.

I end to shop for brand products and started buffet thought. Prior to i started really paying attention to where our currency try supposed, we had been expenses up to $step one,2 hundred thirty days eating dinner out as well as on food.