To shop for a produced home is an affordable treatment for ender new construction try $64,000, than the $324,five hundred to have just one-home, according to the Census Bureau.

But because most are created property – often referred to as mobile house – are not to your house which is owned by the buyer, these include legitimately categorized as individual assets, instance an auto. So you’re able to lenders which can make them increased risk than simply an excellent household, and mortgage pricing will likely be twice what they’re with the an excellent family where in fact the holder as well as possess the residential property it is towards the.

Interest rates into the mobile house are around 8 so you can nine %, a higher level that displays a portion of the high risk out of that have a smaller financial existence and you will depreciating less than site-dependent property, says Greg Prepare, a home loan associate for the Temecula, Calif.

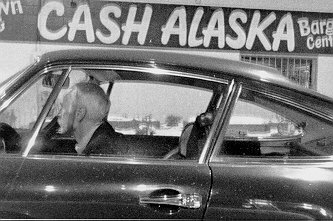

For example buying a car or truck

Several other risk is the fact they have been cellular, Create states. “Once they wished to, they may back it up towards the a great flatbed or any and disperse it out from indeed there,” he states away from owners.

A property towards the repaired belongings is a lot easier to offer than just a good cellular family into property others possesses, Get ready says, and banks don’t want the problem away from speaing frankly about an excellent defaulted financial towards the a cellular house. For example an auto loan where the security ‘s the vehicle, the safety towards a produced home loan ‘s the mobile home.