If you are a national employee-regardless if you are an instructor, firefighter, police officer, or work with any kind of public markets role-buying a property that have a loan may seem instance an emotional activity. But not, there clearly was great: Government staff financial apps can be found to make the home buying techniques smoother and a lot more sensible to you.

These types of apps are especially custom in order to meet the requirements of bodies employees as you. They supply various gurus that can is straight down attract prices into the mortgage loans, less deposit requirements, and versatile qualification criteria.

Government-paid financial programs

Government-paid home loan programs help anybody purchase belongings inexpensively. These include work on because of the governments and you can target communities such as for instance low-income earners, first-time people, experts, or rural owners. This type of software give financial assistance or most readily useful mortgage terms.

Pradhan Mantri Awas YoAY)

PMAY is a flagship construction design released from the Regulators out of India for the purpose away from delivering sensible casing to any or all customers by 12 months 2022.

- Pradhan Mantri Awas Yojana (Urban) getting towns.

- Pradhan Mantri Awas Yoin) to have rural portion.

Below PMAY, regulators employees could possibly get subsidies into lenders for buying otherwise strengthening a property, bleaching the financing burden. Eligibility will be based upon earnings and never buying a great pucca home. Required docs is ID, income certification, and you may house facts. Incorporate via PMAY web site otherwise designated finance companies.

To apply for Spend site otherwise means designated banking companies and you will casing boat loan companies. Acceptance time may differ according to software completeness and you may authority control.

State Construction Plans

Some other claims when you look at the Asia has their property systems aimed at getting reasonable construction to their citizens. These include the fresh new Apna Ghar Apni Dukaan program for the Haryana in addition to Amaravati Casing Scheme inside Andhra Pradesh.

Local government construction strategies render masters eg mortgage subsidies, affordable construction equipment, and you can favorable terms and conditions to own authorities staff. Qualifications utilizes income, residency, and you can employment updates.

Incorporate as a consequence of construction departments or organizations, distribution necessary docs for example money licenses and you can proof of home. Shortly after accepted, appreciate experts predicated on system recommendations.

Personal sector banking institutions mortgage strategies

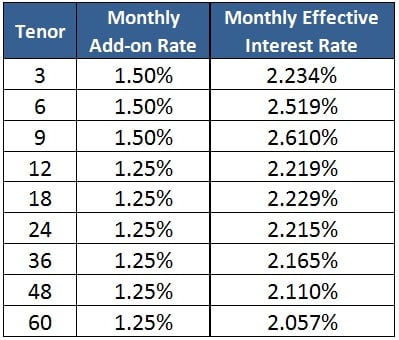

Societal field banking institutions offer diverse mortgage techniques having competitive pricing and versatile repayment selection. Authorities team will delight in benefits such as for example straight down interest rates and shorter costs, aiming to build home ownership convenient.

Eligibility circumstances is earnings, credit history, age, and you can employment condition. Rates and you will terminology are very different by the design and borrower. To use, regulators teams you need records for example ID, earnings facts, and you will assets information, undergoing confirmation. Abreast of approval, finance are paid per lender words.

Certified loan providers

Official creditors focus on certain circles or demographics by offering tailored financial features. In lieu of old-fashioned banking companies, they work on market areas, such as small enterprises, agriculture, otherwise marginalized teams.

Houses boat loan companies (HFCs)

Construction boat loan companies (HFCs) are experts in property financing, providing customized affairs having regulators teams. These types of financing function competitive cost, flexible money, and you will punctual approvals, planning to ease owning a home.

Eligibility standards include income, credit history, a position status, and you can assets valuation, http://availableloan.net/installment-loans-al/riverside having needed paperwork like ID, income proofs, and you may possessions documents. Bodies personnel can put on from HFC’s channels, filling models and you may submission records. On approval, loans is paid based on terminology.

Collaborative banking companies and you will credit communities

Collaborative Banking companies and you may Borrowing from the bank Societies render some financial functions, including lenders, to help you regulators professionals. They give individualized functions and versatile mortgage choice customized on their means.

Funds because of these institutions have a tendency to have advantages for example down desire cost, flexible costs, and you will individualized customer care, and make owning a home more comfortable for bodies teams.

Qualifications conditions always were money, credit history, work position, and you may registration conditions. The application procedure relates to answering models, distribution documents, and you may undergoing confirmation. On acceptance, finance is actually paid with respect to the institution’s terms and conditions.

Staff provident money (EPF) casing scheme

New EPF Houses Scheme allows regulators teams to utilize a percentage of the Staff member Provident Financing (EPF) offers into to buy otherwise developing a house. Which scheme aims to give financial assistance in order to group for the getting housing possessions and satisfying the dream of homeownership.

Authorities professionals can benefit regarding employing their EPF coupons for family funds in lots of ways. Some key has and advantages tend to be:

- Utilizing a portion of obtained EPF savings since a downpayment or limited payment toward home loan.

- Availing aggressive rates on the loan amount borrowed from the EPF discounts.

- Autonomy from inside the repayment selection, have a tendency to aimed having EPF withdrawal rules.

- Potential taxation benefits toward the EPF benefits in addition to family loan payment.

Which are the tax positives and you may incentives?

Bodies personnel choosing home loans may benefit out of certain income tax write-offs and you will bonuses provided with the government. These types of masters aim to remind home ownership among taxpayers and provide financial recovery.

Regulators teams can be get income tax professionals less than Part 24 and you can Area 80C of your Tax Act, as well as other relevant provisions.

- Below Part 24, regulators professionals can also be allege deductions towards appeal paid to the financial, subject to certain restrictions.

- Area 80C allows deductions on dominant payment of the property loan, with other qualified investments including Provident Finance contributions and you can insurance premiums.

Do you know the judge and regulating factors?

Government team need to perform comprehensive verification away from belongings headings and you may paperwork before buying possessions, ensuring control position, lack of problems, and you may correct files to eliminate legal issues.

Mortgage apps for regulators employees are regulated from the government statutes, dictating eligibility, interest levels, terms, and you can files. Adherence is a must getting effortless benefit supply.

Conformity with court and regulatory standards is very important to own bodies teams availing lenders and buying possessions to eliminate conflicts, penalties, otherwise benefit forfeiture. Seeking to legal advice is advisable to make sure adherence from the process.

For those who want help on entire process having a good financial, the essential a good idea action is to try to search monetary pointers. You can also consider contacting Borrowing from the bank Dharma, a customized consultative provider to guide you during the navigating the fresh new complexities out of financing procedures.