In the Costs, we try to create monetary choices with confidence. Even though many of one’s activities analyzed come from the Providers, along with individuals with hence we’re affiliated and those that compensate us, our very own evaluations are never influenced by her or him.

Skyrocket Mortgage and its member Rocket Financing offer dollars-away refinancing and personal finance, so they possess options for people and you will low-people equivalent.

Do Rocket Mortgage Offer Family Guarantee Finance or HELOCs?

Rocket Mortgage and its associated businesses promote one or two alternatives to help you house equity finance and you will HELOCs that would be helpful in some examples. Such choice is dollars-out refinance funds and personal finance.

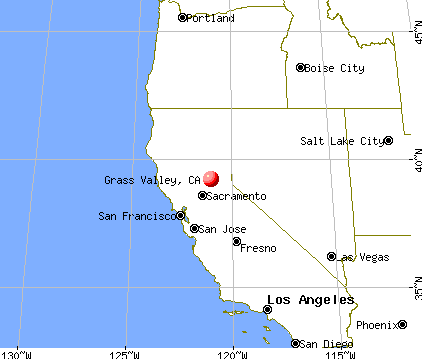

Rocket Financial depends for the Detroit, MI, but works in most 50 says. He’s part of a family group away from companies that will bring mortgage loans and private finance including house and you will auto buying attributes. Skyrocket Home loan was once known as Quicken Financing.

According to organization’s website, Rocket Home loan is the largest lending company in the us. In 2020, it closed $320 million value of mortgage loans.

Total, the business possess twenty-six,one hundred thousand teams and you will works offices from inside the four other claims. The arrive at is actually all over the country, via just what company means given that the initial completely on the web financial sense.

This on the internet stress lets mortgage applicants to complete the whole techniques without dealing privately having salespeople or bankers. Although not, the program really does render usage of lending experts when wished.

Cash-away refinancing

Such a house equity financing, a funds-away home mortgage refinance loan try a way of experiencing this new guarantee when you look at the a property discover bucks. Yet not, rather than simply credit against guarantee, cash-away refinancing concerns replacement the new homeowner’s newest home loan which have a more impressive loan. One to larger mortgage allows borrowers to replace their established home loan and you can utilize the kept dollars to many other objectives.

Cash-away re-finance funds tends to be a much better alternative to house guarantee funds where new loan’s interest is significantly below regarding the existing home loan together with number of bucks applied for is a huge portion of the full number lent. The reason which issues would be the fact discover surcharges for cash-aside refinancing, and manage ranging from .375% and step three.125% of one’s whole amount borrowed not only the bucks out. A great step 3% percentage towards the a $300,one hundred thousand financial was $9,100000 americash loans Pickensville. It does not seem sensible when you are checking having $20,one hundred thousand bucks.

Cash-out refinancing may possibly not be an installment-effective replacement for a house equity loan if for example the the new appeal rate isnt considerably lower than the existing you to definitely. That’s because the charge working in taking a separate financial you’ll get this to an expensive way of accessing house equity.

Unsecured loans

Another solution given by Skyrocket Mortgage is actually a personal loan. Personal loans tends to be safeguarded otherwise unsecured. Secured makes them backed by guarantee, if you’re personal loans rely more about this new borrower’s credit rating and financial situation.

Signature loans generally have high interest levels than mortgages. Some personal loan company do render prices that contend with those people from home collateral loans, in the event the individuals are particularly accredited. And you may centered on Federal Reserve analysis, personal loan pricing are usually much cheaper than borrowing on a good mastercard. This means unsecured loans are an installment-effective source of borrowing from the bank getting borrowers that simply don’t features a substantial number of equity in property.

Getting a personal bank loan would depend significantly towards borrower’s credit score and you will financial predicament. There are generally speaking fees of the launching a loan, and work out signature loans less cost-effective to own small amounts.

Rocket Financial Home Collateral Financing

Because Skyrocket Home loan will not already give home security money, an alternative way regarding making use of the fresh security when you look at the property for money was a money-aside home mortgage refinance loan.