For example, if your accounting periods last one month, use month-end closing entries. However, businesses generally handle closing entries annually. Whatever accounting period you select, make sure to be consistent and not jump between frequencies. When you manage your accounting books by hand, you are responsible for a lot of nitty-gritty details.

Closing entry for net income

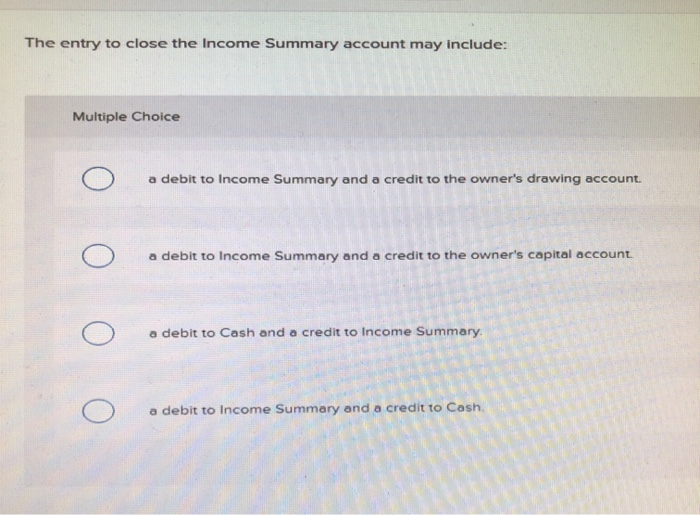

If the income summary account has a net credit balance i.e. when the sum of the credit side is greater than the sum of the debit side, the company has a net income for the period. Conversely, if the income summary account has a net debit balance i.e. when the sum of the debit side is greater than the sum of the credit side, it represents a net loss. From this trial balance, as we learned in the prior section, you make your financial statements.

What is the Income Summary Account?

In essence, we are updating the capital balance and resetting all temporary account balances. As you will see later, Income Summary is eventually closed to capital. Post the transactions to the income summary account and close the income summary account. This net balance of income summary represents the net income if it is on the credit side.

Related posts:

In the last 10 years, she has worked with clients all over the country and now sees her diagnosis as an opportunity that opened doors to a fulfilling life. Kristin is also the tax evasion vs tax avoidance creator of Accounting In Focus, a website for students taking accounting courses. Since 2014, she has helped over one million students succeed in their accounting classes.

7: Closing Entries

The income summary account is only used in closing process accounting. Basically, the income summary account is the amount of your revenues minus expenses. You will close the income summary account after you transfer the amount into the retained earnings account, which is a permanent account. After that, the income summary account will be transferred further to the retained earnings account in the balance sheet. The company can make the income summary journal entry for the expenses by debiting the income summary account and crediting the expense account. The company can make the income summary journal entry for the revenue by debiting the revenue account and crediting the income summary account.

- Conversely, if the income summary account has a net debit balance i.e. when the sum of the debit side is greater than the sum of the credit side, it represents a net loss.

- The balances of these accounts are eventually used to construct the income statement at the end of the fiscal year.

- To do this, their balances are emptied into the income summary account.

- The net income (NI) is moved into retained earnings on the balance sheet as part of the closing entry process.

- Temporary accounts are used to record accounting activity during a specific period.

- Remember that the periodicity principle states that financial statements should cover a defined period of time, generally one year.

Otherwise, the balances in these accounts would be incorrectly included in the totals for the following reporting period. Below are examples of closing entries that zero the temporary accounts in the income statement and transfer the balances to the permanent retained earnings account. Accountants may perform the closing process monthly or annually. The closing entries are the journal entry form of the Statement of Retained Earnings. The goal is to make the posted balance of the retained earnings account match what we reported on the statement of retained earnings and start the next period with a zero balance for all temporary accounts.

The income summary is a temporary account that its balance is zero throughout the accounting period. The company only uses this account at the end of the period to clear all accounts in the income statement. Likewise, after transferring the balances of all accounts in the income statement to the balance sheet, the income summary balance will become zero again. As mentioned, temporary accounts in the general ledger consist of income statement accounts such as sales or expense accounts. When the income statement is published at the end of the year, the balances of these accounts are transferred to the income summary, which is also a temporary account. Likewise, after transferring all revenues and expenses to the income summary account, the company can make the journal entry to close net income to retained earnings.

The balance in a company’s income summary account must be transferred to retained earnings to take the amount off the company’s books. The income summary account is a temporary account used to store income statement account balances, revenue and expense accounts, during the closing entry step of the accounting cycle. In other words, the income summary account is simply a placeholder for account balances at the end of the accounting period while closing entries are being made. A closing entry is a journal entry made at the end of an accounting period. It involves shifting data from temporary accounts on the income statement to permanent accounts on the balance sheet. Temporary accounts include revenue, expenses, and dividends.

Debit the income summary account and credit expense account. First, transfer the $5,000 in your revenue account to your income summary account. Whether you credit or debit your income summary account will depend on whether your revenue is more than your expenses. Accounting software automatically handles closing entries for you. If you don’t have accounting software, you must manually create closing entries each accounting period. In this case, the income summary account has a net credit balance which means that the company has a net income of $5 million.