Information NRI Home loan EligibilityThe eligibility criteria having an NRI to help you secure home financing within the India is collection of however, simple:Ages Limitation: Individuals must be no less than 18 yrs old and not surpass sixty decades during the time of loan maturity

For most low-resident Indians (NRIs), owning a home in Asia isn’t only a financial investment however, a relationship to the sources. Because of the sturdy growth in India’s a house has actually seen an enthusiastic growing number of NRIs investing in possessions across the country. Taking that it pattern, Indian banks has tailored home loan points particularly for NRIs, making the procedure more available and you will smooth than ever. This guide delves for the basic principles out-of protecting a mortgage from inside the Asia as the an NRI, out-of qualification towards the application processes, in addition to monetary nuances inside it.

A career Status: NRIs should have a reliable occupations overseas, which have the absolute minimum work several months according to lender’s policy.Earnings Stability: The cash requirements will vary of the bank however, fundamentally need the candidate to have a steady income to support loan money.

Uses for Securing an enthusiastic NRI Family LoanNRIs are eligible to make use of to have lenders many different objectives:Household Get: To purchase a different sort of or resale domestic. House Buy: Obtaining a plot to possess coming design. Construction: Strengthening property towards owned land.

Necessary DocumentationApplying to own home financing requires NRIs so you can give numerous documents getting term confirmation, income research, and assets info:KYC Data files: Passport, to another country target facts, Indian target proof (if appropriate), Dish card, and an image.Money Proof: Previous paycheck slips, overseas financial statements, and you will taxation productivity.

Several Indian banking companies are notable for its NRI-amicable home loan products:State Lender regarding IndiaHDFC BankICICI BankAxis BankThese financial institutions just provide aggressive interest levels in addition to render support service in both Asia and major foreign places, which makes them available to NRIs globally.

Rates of interest inside the 2024Interest prices for NRI lenders is actually competitive, which have banks getting costs in accordance with the applicant’s credit reputation and you can the borrowed funds particular. For instance:Kotak Mahindra Lender: Undertaking from the 8.70% per annum County Financial from India: Out of 8.60% per annum HDFC: Up to 8.50% per year

Tax Experts towards the NRI House LoansNRIs is get by themselves off high income tax professionals with the lenders:Part 80C: Deduction as much as Rs. step 1.5 lakh towards Altona loans dominating fees a-year.Section 24B: Deduction all the way to Rs. 2 lakh into the attention commission annually.These pros can aid in reducing the full taxable income off a keen NRI, offering specific recovery considering its around the globe income tends to be at the mercy of taxation from inside the Asia based on the home standing.

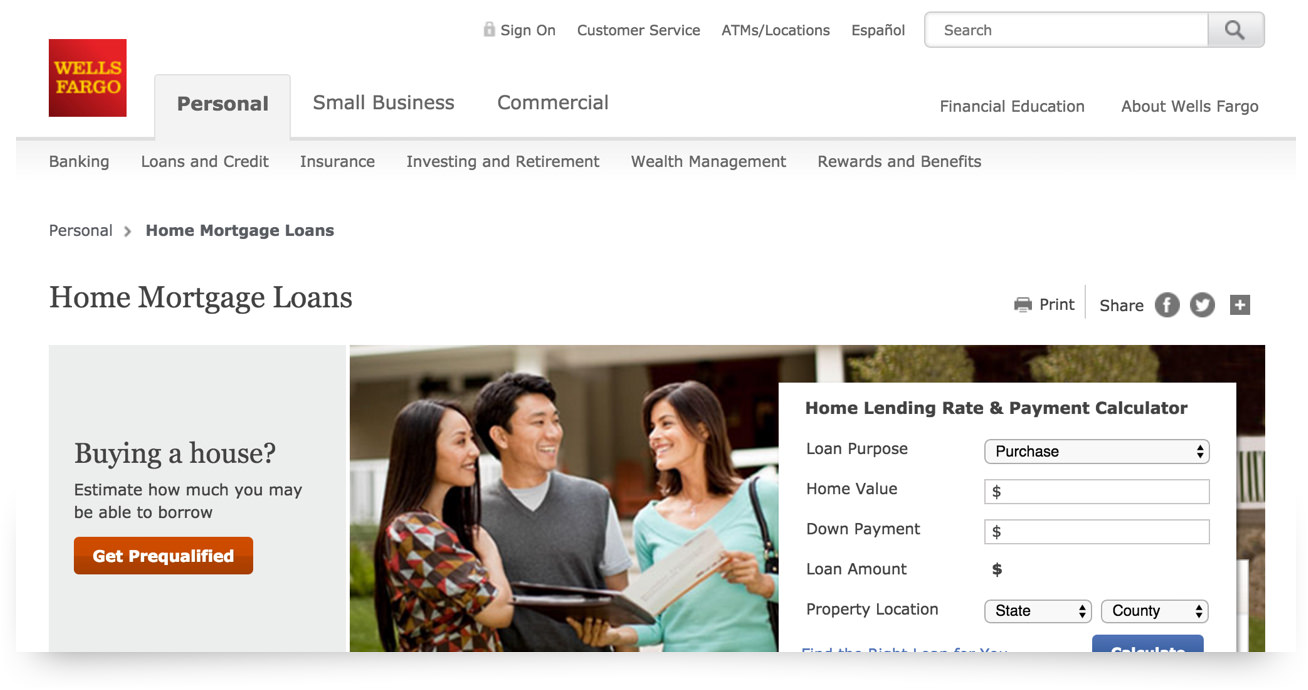

Application Procedure: Tips to FollowOnline Application: Check out the formal website of one’s selected bank to help you submit the application form. Banks particularly HDFC and SBI offer loyal sites getting NRIs.Document Submitting: Publish otherwise courier the mandatory files because the specified because of the bank.

Mortgage Sanction: Article confirmation, the mortgage try sanctioned

This process takes a few weeks.Loan Disbursement: On contract finalizing and you may last assets verification, the loan amount was paid.

Things to Be on the lookout ForExchange Speed Fluctuations: As mortgage repayments are generally produced in INR, changes in rate of exchange can impact extent you get investing.Legal Clearances: Make sure the assets enjoys all needed courtroom clearances to eliminate upcoming problems.

ConclusionThe process of getting a home loan from inside the Asia as the an enthusiastic NRI within the 2024 are smooth but need consideration of various things as well as choosing the right financial, understanding the taxation ramifications, and navigating from the legal landscaping regarding Indian a home. On the correct preparation and you can information, NRIs can be effectively secure a mortgage to purchase the dream assets inside India,so it is an important capital for the future.

Disclaimer: The fresh new opinions conveyed a lot more than is to own informational motives merely based on business profile and you will related development tales. Possessions Pistol does not make sure the precision, completeness, or reliability of one’s recommendations and you can shall not be held accountable the step removed based on the wrote guidance.