- Customer service: How will you get in touch with support service if you have a question? Understand the instances and just how receptive they are. This is an enormous buy and you also desire to be confident that have just who you’re writing on.

Get an excellent Va Financing

Once you have made your Va mortgage selection, you will need to render your own COE to exhibit your eligible to be eligible for a good Va financing. You can get it via your eBenefits webpage or by the asking for they from send. 2nd, might manage financing officer and you will done a credit card applicatoin, get borrowing run, and have now pre-qualified for the mortgage. You want their social safeguards matter and you can personality and just have need proof of income such as for instance an income tax get back. It can make the process much easier when you’re planned while having the of data handy.

What exactly is a Virtual assistant Mortgage?

A great Va loan was backed by the federal government and that’s open so you can effective and you can previous services participants and their enduring spouses within the some instances. You can play with an effective Va mortgage buying or make a great house, raise and fix property, or re-finance a mortgage. High professionals were shorter credit history conditions, zero private mortgage insurance, no down-payment requisite, and you may aggressive cost.

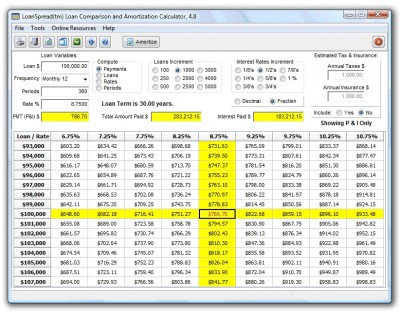

You could get an excellent Virtual assistant financing over and over again, although funding fee develops when using a good Va loan shortly after your first time. New Virtual assistant financial support percentage is actually a-one-day charge which you spend when you get a good Virtual assistant-guaranteed financial to purchase or refinance your residence. Oftentimes, you have the possibility to help you roll the fresh Va financial support payment on the loan. An average money fee ranges from one.4% to three.60% of your amount borrowed.

You will want a beneficial COE, which you can see in the Virtual assistant site, or your financial will help you with this particular. To obtain that it certification, you will have to produce services-related records, that may vary based on regardless if you are on effective duty or an experienced.

Perform Virtual assistant Funds Are different from the Bank?

The two fundamental suggests a good Virtual assistant mortgage can vary somewhat out-of financial so you’re able to bank are definitely the price and also the lowest credit score. The brand new Va doesn’t underwrite the loan; it gives a vow toward lenders exactly who offer the mortgage program. Lenders dictate brand new pricing they will certainly provide, as well as the other underwriting direction might comply with, like your credit score and you can financial obligation-to-income proportion.

Credit rating minimal standards disagree somewhat off lender so you can bank, with most settling on 620 since their acknowledged minimum. Credit limits commonly put by You.S. Company out-of Veteran Activities. The brand new VA’s merely borrowing demands is for the brand new debtor as noticed a satisfactory borrowing risk of the a lender.

The great benefits of a Va financing are exactly the same it does not matter and that financial you select. The many benefits of the https://paydayloancolorado.net/somerset/ application form are no down payment requisite, zero PMI requirements, with no prepayment punishment, which have a Virtual assistant investment fee bringing the host to the new PMI.

The latest Va provides what are named minimum assets standards. They’ve been non-negotiable items like construction defects, pest infestation, leakage, pness, and continuing settlement in the or near the base. While providers involved with buyers whom give a low-Virtual assistant mortgage for the get normally discuss the latest repair will set you back away from such products, the fresh Virtual assistant program need these products to get fixed in advance of it deliver the financial institution new acceptance in order to right back the fresh new lender’s home loan loan into the debtor. One to leaves pressure on the supplier to solve these issues mostly on the costs if they wish to be capable promote their property for the customer just who gift ideas that have good Virtual assistant loan in their wallet.