Contents:

Sage Intacct Advanced financial management platform for professionals with a growing business. But while the first scenario is a cause for concern, a negative balance could also result from an aggressive dividend payout – e.g. dividend recapitalization in LBOs. However, if you have one or two investors in your business, you’ll want to list the amount of money distributed to them during this period. Other special reporting issues include Earnings per Share, Retained Earnings and Intraperiod Tax Allocation. Finance Strategists is a leading financial literacy non-profit organization priding itself on providing accurate and reliable financial information to millions of readers each year.

Net income is the amount of your business’s revenue minus expenses. Dividends paid is the amount you spend on your company’s shareholders or owners, if applicable. You must use the retained earnings formula to set up your statement of earnings. The formula helps you determine your retained earnings balance at the end of each business financial reporting period.

Purpose of Retained Earnings Statement

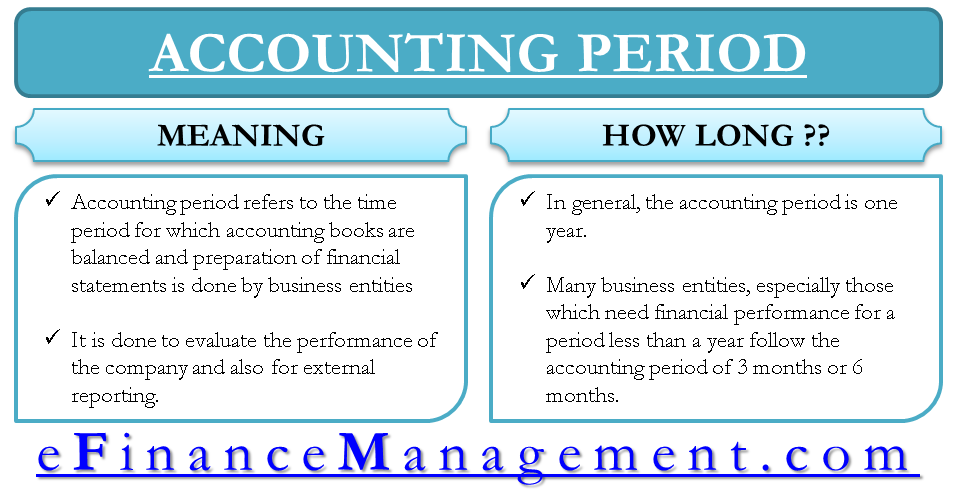

The company can use this amount for repaying its debts, or reinvesting them in its operations for expansion and diversification. The statement breaks down changes in the owners’ interest in the organization and in the application of retained profit or surplus from one accounting period to the next. The statement of retained earnings explains the changes in a company’s retained earnings over the reporting period. This operating statement reveals how cash is generated and expended during a specific period of time. It consists of three unique sections that isolate the cash inflows and outflows attributable to operating activities, investing activities, and financing activities.

Others might split the gains, or distribute the surplus to investors. Accumulated DepreciationThe accumulated depreciation of an asset is the amount of cumulative depreciation charged on the asset from its purchase date until the reporting date. It is a contra-account, the difference between the asset’s purchase price and its carrying value on the balance sheet.

Define Accounting cycle and state the phases involved in an Accounting cycle. – Mapsofindia.com

Define Accounting cycle and state the phases involved in an Accounting cycle..

Posted: Fri, 31 Mar 2023 07:00:00 GMT [source]

incremental cost specifically apply to corporations because this business structure is set up to have shareholders. If you own a sole proprietorship, you’ll create a statement of owner’s equity instead of a statement of retained earnings. A profitable company can also experience negative retained earnings. This can happen when the company pays out more dividends than money is available.

Why You Can Trust Finance Strategists

The statement gives details of retained earnings at the beginning of the current year, net income or net loss generated in the current year and the dividend paid throughout the current year. As a result, the retained earning’s amount carried forward to the balance sheet is also shown here. It is a very effective tool for various stakeholders in assessing the health of the company if used correctly. Creditors view this statement as well, as they want to look at several performance measures before they can issue credit to a company.

- John wants to understand how his business is performing financially, so he creates a statement of retained earnings.

- When a company buys back its stock, it reduces the number of outstanding shares and increases the value of each remaining share.

- But beyond that, those who want to invest in a business will certainly expect the owner or manager to understand its value because they’re not just investing in the business; they’re investing in them too.

- Retained earnings does not reflect cash flow, but rather the money left over after financial obligations have been paid.

- The statement of retained earnings is either created as a separate document or appended with the income statement and balance sheet.

XYZ Ltd. is a start-up bakery that has been operating for two years. The company’s accountant is preparing the statement of retained earnings for the year ending December 31, 2023. The term “Statement of Retained Earnings” originated from accounting and finance. The concept of retained earnings and preparing a statement to report them has been used since the early 20th century. The first use of the term “Statement of Retained Earnings” is unclear, but it likely became widely used after financial accounting standards and practices were widely adopted. Generally, companies with a strong financial position and a solid growth history tend to retain a more significant portion of their earnings than those with weaker financials.

Retained Earnings in Accounting and What They Can Tell You

The financial statements provide feedback to the owners regarding the financial performance and financial position of the business, helping the owners to make decisions about the business. Another way to think of the connection between the income statement and balance sheet is by using a sports analogy. The income statement summarizes the financial performance of the business for a given period of time.

This helps complete the process of linking the 3 financial statements in Excel. Distribution of dividends to shareholders can be in the form of cash or stock. Cash dividends represent a cash outflow and are recorded as reductions in the cash account. These reduce the size of a company’s balance sheet and asset value as the company no longer owns part of its liquid assets. Retained earnings are one of the many financial metrics used to assess a company’s financial health. They can be defined as what remains of a company’s net income after all expenses, including shareholder dividends, have been paid out.

Every finance department knows how tedious building a budget and forecast can be. Integrating cash flow forecasts with real-time data and up-to-date budgets is a powerful tool that makes forecasting cash easier, more efficient, and shifts the focus to cash analytics. Additionally, retained earnings must be viewed through the lens of the business’s stage of maturity. More mature businesses typically pay regular dividends whereas growing businesses should be using retained earnings to fuel growth. Preparing a Statement of Retained Earnings requires a clear understanding of accounting principles and attention to detail. Depending on the company’s jurisdiction, this statement should be prepared by Generally Accepted Accounting Principles or International Finance Reporting Standards .

Notice to attend the annual general meeting of SyntheticMR AB (publ) – Marketscreener.com

Notice to attend the annual general meeting of SyntheticMR AB (publ).

Posted: Fri, 14 Apr 2023 05:24:04 GMT [source]

Additionally, they are considered a sign of the https://1investing.in/‘s stability, as they reflect the profits that have been reinvested into the business instead of being paid out to shareholders. The Statement of Retained Earnings is a Financial Statement prepared by corporations that details changes in the volume of Retained Earnings over some period. Retained Earnings are profits held by a company in reserve in order to invest in future projects rather than distributed as dividends to shareholders. From this data, you can calculate the retention ratio by dividing the retained earnings by the net income.

Dividends and Retained Earnings

We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. The first example shows an increase in retained earnings, while the second example shows a decrease. Dividends paid are not classified as an expense but rather a deduction of retained earnings. Many corporations retain a portion of their earnings and pay the remainder as a dividend. If the error has not counterbalanced then an entry must be made to retained earnings.

Line items typically include profits or losses, dividends paid, redemption of stock, and any other items credited to retained earnings. Financial accounting seeks to directly report information for the topics noted in blue. Additional supplemental disclosures frequently provide insight about subjects such as those noted in red.

Ultimately, they have to make the decision to keep the shareholders happy. Retained earnings tell the Board how much money the company has, and enables them to make an informed decision. The statement of retained earnings shows how the retained earnings have changed during the financial period. This financial statement provides the beginning balance of retained earnings, ending balance, and other information required for reconciliation. One way to assess how successful a company is in using retained money is to look at a key factor called retained earnings to market value.

The financial press and television devote seemingly endless coverage to headline events pertaining to large public corporations. Public companies are those with securities that are readily available for purchase/sale through organized stock markets. Many more companies are private, meaning their stock and debt is in the hands of a narrow group of investors and banks.

The dividend payout ratio is the measure of dividends paid out to shareholders relative to the company’s net income. On one hand, high retained earnings could indicate financial strength since it demonstrates a track record of profitability in previous years. On the other hand, it could be indicative of a company that should consider paying more dividends to its shareholders. This, of course, depends on whether the company has been pursuing profitable growth opportunities.