Credit sales are sales in which a company expects the buyer to pay the price within a certain period. Unlike cash sales, in which the buyer has to pay the cash on spot, credit sales are flexible in respect of the actual payment of the invoice. Furthermore, customers can generate cash flow before paying the seller, which can lead to more regular purchases. Credit sales can also provide businesses with more control over their cash flow since they can receive payments in installments rather than in one lump sum. The sales discount allows the customer to pay an amount that is lesser than the actual total for their purchase.

AccountingTools

The credit sales journal entry is an important accounting entry for businesses. With this method, transactions are abnormally recorded in two or more accounts simultaneously. These entries generally involve a credit to one or more accounts and a debit to one or more accounts. These entries are normally equal but opposite; thus when one account increases, the other decreases. Additionally, the amounts recorded must be equal to each other; a credit of $10 to an account must be followed by a debit of $10 to another account.

What does the Accounting Entry Look like for Credit Sales with a Discount?

- The credit to the sales account will indicate that the company has earned revenue on the sale.

- In this scenario, if a company offers net-30 payment terms to all of its clients, a client can decide to purchase an item on April 1; however, they would not be required to pay for the item until May 1.

- It is an asset that is expected to be converted into cash within a relatively short period of time, usually no longer than a year.

- In this case, the debtor’s account or account receivable account is debited with the corresponding credit to the sales account.

- When cash is collected, the company debits cash account and credit accounts receivable.

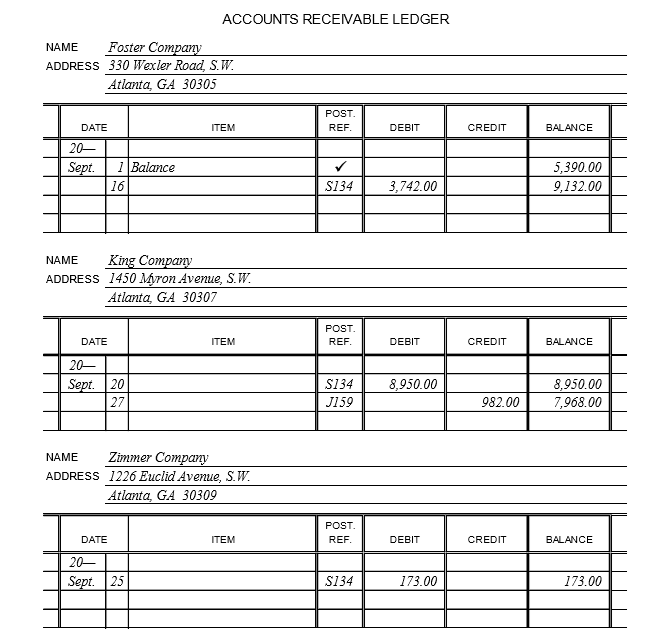

The sales journal is simply a chronological list of the sales invoices and is used to save time, avoid cluttering the general ledger with too much detail, and to allow for segregation of duties. The sales journal records all credit transactions involving the firm’s products. Only inventory and other merchandise sales are recorded in the sales journal. Credit sales are reported on both the income statement and the company’s balance sheet. On the income statement, the sale is recorded as an increase in sales revenue, cost of goods sold, and possibly expenses. Woodworks, Inc. wants to write off the uncollected credit sales as bad debts expense.

Types of Sales Transactions

The buyer then has a certain period of time, known as the credit term, in which to pay the seller back. These potential disadvantages should be taken into consideration when making the decision to offer credit sales to customers. Careful analysis and appropriate risk management strategies can help to minimize the negative impacts of offering credit sales. Some businesses simply have one column to record the sales amount whereas others need additional columns for sales tax, delivery fees charged to customers etc. The multi-column journal should always have an ‘other’ column to record amounts which do not fit into any of the main categories. If the customer later pays off the balance owed, you would then make a second journal entry that reverses the original transaction.

Allowing Businesses to Spot Trends

Each of these three types of sales transactions has their own advantages and disadvantages. If your business is ever audited by any government agency, the sales journal will be credit sales journal entry one of the first places they look. The sale date, the buyer’s name, the purchase price, and the amount owed by the buyer must all be included in the sales credit log entry.

Providing an Up-to-Date Record of Credit Sales

This is a key competitive tool in some industries as it can attract additional customers through the provision of longer payment terms. These payment delays can therefore be beneficial for both the buyer and the seller, allowing customers to take advantage of goods and services and generating additional revenues for the seller. Each sale invoice is recorded as a line item in the sales journal as shown in the example below. If you have a complete and accurate sales journal, it will make preparing your business taxes much easier come tax time. On 31st April 2020, ABC Inc. sold XYZ Inc. products worth $1,000 that are subject to a 10% tax. In the aforementioned illustration, Apple Inc. is providing a 10% discount to Jimmy Electronics if they pay by May 10 or earlier.

Now we will understand how to show all the above entries in financial statements. For example, if you notice that your sales spiked during a certain week in the past, you might want to try to replicate that promotion or sale again. Apple Inc., a retailer of laptops and computers, gave Jimmy Electronics credit for $50,000 worth of items on May 1, 2020. Consider the same example above – Company A selling goods to John on credit for $10,000, due on January 31, 2018. However, let us consider the effect of the credit terms 2/10 net 30 on this purchase. Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University.

This allows customers to have access to goods and services they may not have the immediate cash flow to purchase, while still providing the seller with the assurance of payment. For instance, an invoice that indicates “5/10 net 30” means the customer will receive a 5% discount if the amount owed is paid within 10 days. Otherwise, the customer has to pay the full invoice amount within 30 days from the time of purchase. The double-entry bookkeeping system ensures the accuracy of financial records by ensuring that every transaction is recorded in two places.