Pinpointing a keen assumable financial

Particular homebuyers zero when you look at the on the concept of seizing an effective financial and positively choose home postings in their town one is applicants getting financing expectation. These look you certainly will cover seeking postings you to definitely genuine estate agents was selling because assumable home loan or house posts because of the providers with regulators-recognized financing. (Extremely assumable fund try bodies-recognized financing; more on that below.)

In other cases, a purchaser could possibly get suppose a home loan away from some body they are aware. Or, once deciding on a house to find, a buyer and their broker get know it is a prime applicant for mortgage expectation and talk about the suggestion on merchant.

To compensate owner into security they have built up inside our home (ie. what they have already paid down that have monthly payments and one appreciate on property’s value), you’ll likely have to make a massive initial percentage in their mind so you can commit to offer their home in that way.

Manufacturers either have fun with its assumable mortgage loans since the a bargaining chip from inside the our home sale procedure because they know it can help to save the fresh customer money on attract. That result in the house a far greater package in the much time manage versus other attributes in the region.

That means that since the consumer you may have to evaluate whether it is worth it to pay a top speed upfront getting a reduced interest.

Get acceptance towards exchange

The loan bank (and maybe also a branch of one’s authorities department support the home loan) usually should bring acceptance to possess a purchaser to visualize a beneficial mortgage away from a supplier. In this case, there’ll be a keen underwriting process, that has a credit and you can monetary evaluation of the fresh debtor that may imagine things like the debt-to-income ratio.

The new methods having approval count on the kind of cash loan usa Tidmore Bend Alabama government-right back mortgage. Such as, with Va fund, you will probably need to get approval from the local Va loan heart. These government acceptance procedure can be drag out the schedule of transaction. (Note: The consumer doesn’t need to fulfill all the lender’s brand spanking new qualifications requirements for brand new loans into certain loan system so you can guess home financing. Eg, you don’t have to getting a veteran to visualize a great Virtual assistant loan.)

Closing

The typical measures away from homebuying still pertain once you imagine home financing, which means you can expect to pay closing costs. Having said that, you may stretch your budget here since you usually do not require an appraisal which have a keen assumable mortgage.

Once you finish the closing processes, new holder is likely with the home loan plus the seller is actually from the connect for those mortgage payments.

There are various a means to structure financing for choosing an excellent home. You to lesser-known strategy is which have an assumable mortgage. This is what that implies as well as how it truly does work:

What exactly is a keen Assumable Financial?

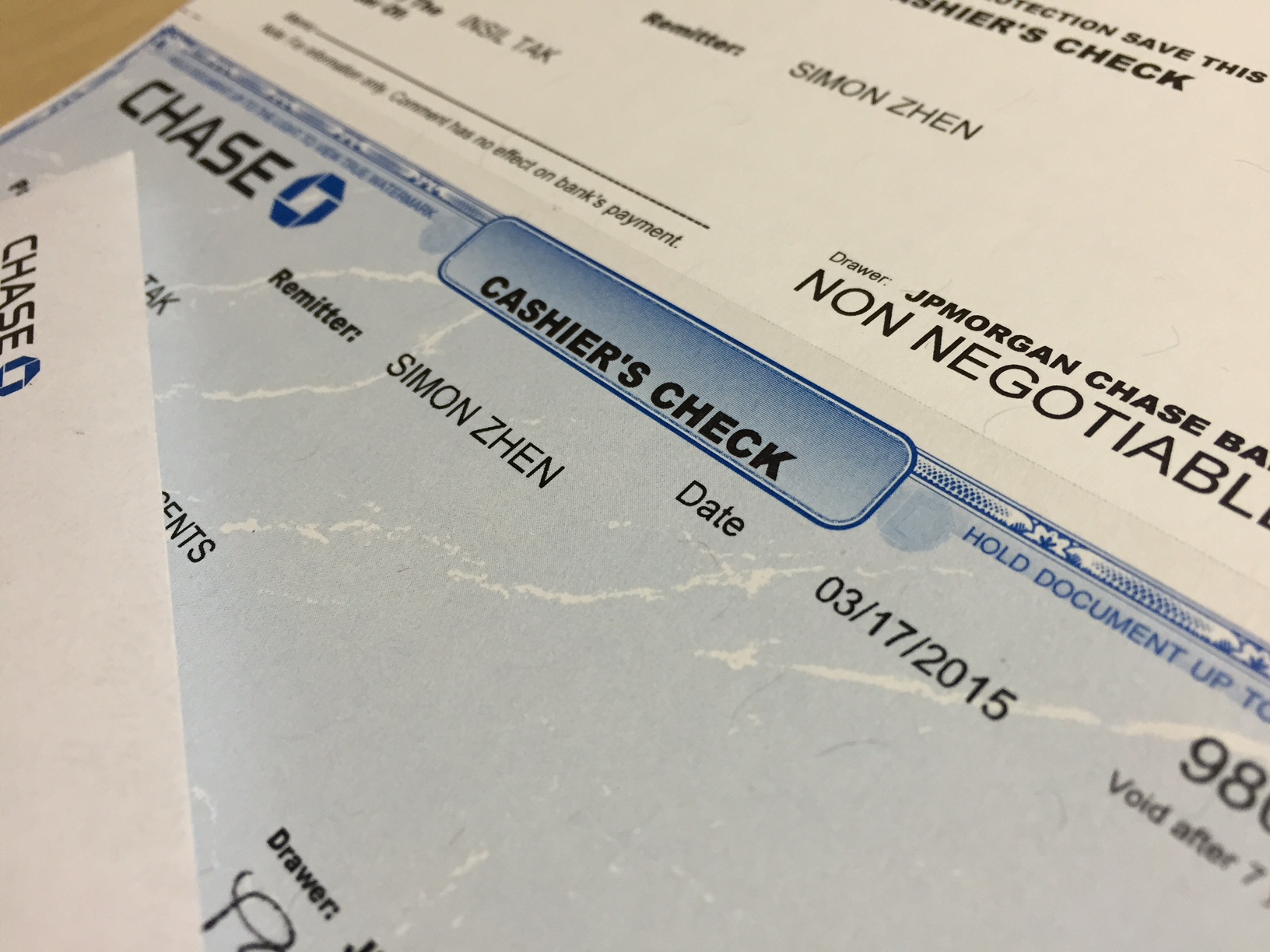

An assumable mortgage is actually home financing where in actuality the visitors legally gets control of the fresh seller’s home loan. The buyer assumes on payments, right the spot where the seller left-off. The buyer would need to pay the merchant the essential difference between the cost in addition to leftover financial equilibrium, in both dollars otherwise with an extra financial. No appraisal of the house needs, but customers should however acquisition monitors to make certain truth be told there are no shocks following the sale shuts. After it can intimate, the customer ‘s the the brand new proprietor of the loan together with merchant is taken away from the financial.

- Current Rates of interest Is HighIf supposed sector mortgage cost are presently greater than the rates for the seller’s mortgage, the consumer will save tens of thousands of bucks during the focus throughout the borrowed funds.