Trying to have the reasonable rate of interest you can easily? Just what seems like a trivial difference in the course of time helps you save alot more currency, based on how a lot of time your remain in your residence.

Shorter incentives

This is certainly the obvious benefit of transitioning so you’re able to a great 15-year home loan. Consider what you can manage should your home is paid down that much fundamentally! Immediately following lofty specifications from resource your infant’s college tuition, increasing your senior years efforts, or to purchase a residential property be effortlessly attainable.

Downsides out-of a beneficial fifteen-seasons financial

Not every borrower are a candidate to help you refinance to a 15-seasons home loan. However, here are some inquiries to ask your self in advance of extend to help you a lender.

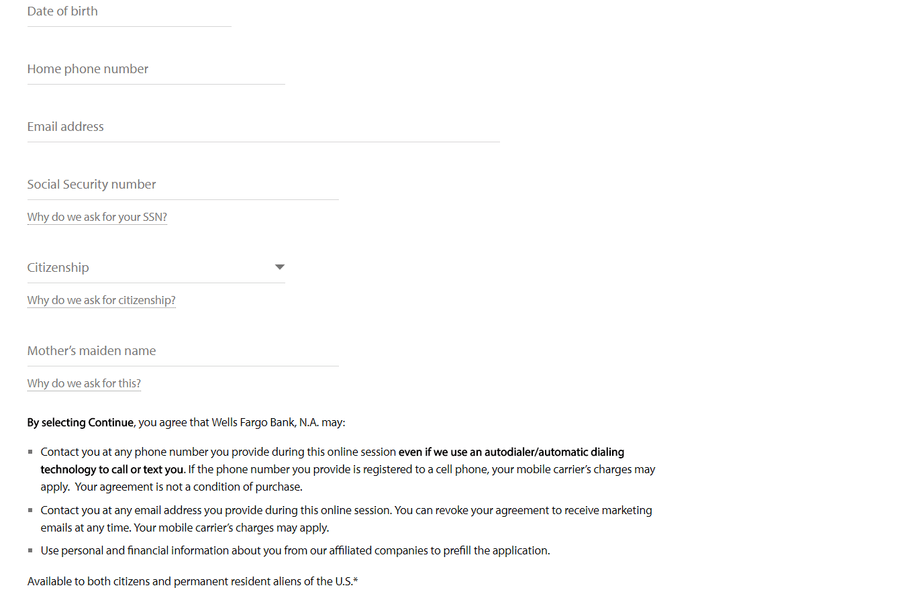

Must i afford the payments? – Be honest that have oneself: are you willing to manage earmarking much more currency every month for the financial? Basic, you ought to assess all of your economic picture. Will be your domestic earnings secure enough to withstand a top payment? When your response is yes, definitely possess a checking account that safeguards 3-6 months off expenditures. Increased part of your earnings heading into the house payment renders a safety net far more critical.

Am i going to miss the independency with security? – Consumers every where is capitalizing on ascending home values which have a beneficial cash-aside refinance. In a nutshell, that it transaction involves taking out fully a new home loan which have a high loan amount and you can pocketing the difference (a portion of the collateral) just like the cash. Among cons off refinancing to good 15-year mortgage is that you may not have which amount of autonomy together with your equity. Subsequently, there can be a good chance you’re going to have to move to signature loans otherwise playing cards to fund home improvements.

Do I have enough currency left some other concerns? – So it concern connections back into the fresh cost that significantly more than. No matter if everybody’s economic climate is different, you need to be aware of the purpose. Like, will it add up in order to lead shorter to old age levels in order to re-finance to help you an excellent 15-12 months home loan? Likewise, could you be comfy paying even more a lot of money or even more every few days on their mortgage in the event the rainy go out loans isn’t really a little the place you like it to be?

Will i remove particular taxation benefits? – Remember in regards to the home loan attract taxation deduction you have feel used to in order to with a 30-seasons financing. Paying their mortgage in two the amount of time does mean you are able to get rid of so it deduction at some point. Believe talking-to an income tax elite while you are concerned with just how a good 15-year loan you may effect the tax liability later.

15-seasons mortgage against. 30-seasons financial

There are several reasons why the typical American resident favors good 30-seasons mortgage. For one thing, it permits getting higher monetary self-reliance. The low percentage provides borrowers the chance to create guarantee if you find yourself checking up on other loans money and you will stashing away bucks to have an urgent situation.

The right applicant having a good fifteen-season home loan generally speaking inspections a couple of boxes: he has a stable jobs with no major debt obligations. As this individual are personal bank loans for bad credit South Dakota able the higher monthly payment, they would not be smart so they are able spend an additional 15 years’ value of appeal. not, do it be better out-of still which have a 30-seasons mortgage because of the related taxation write-offs?

At the same time, a great candidate for a thirty-year mortgage possess the typical otherwise just beneath-average income. As opposed to people who can afford a good fifteen-year title, these particular borrowers generally don’t have the information to handle a beneficial notably higher mortgage payment. They tend to have many other economic desires and you may loans for example paying student loans otherwise starting children.